Version 3.15.1

Spend Rules Optimisations

Spend rules capabilities for both the Multi and Back office APIs will allow a more granular configuration & management. This new framework will provide improved efficiencies in rule configuration; in addition to API optimisations, and reduced impact from future rule changes/introductions.

The following information highlights the specific areas changing and what this will now provide:

Setting card level spend rules

The PUT Spend Rules API endpoint will be deprecated in favour of 3 new API endpoints:

- Create spend rules config API endpoint: This new POST API endpoint should be used when setting up the spend rules for the first time on a card.

- Update spend rules config API endpoint: This new PATCH API endpoint should be used when spend rules have already been set on a card and these need amending to add or alter the rules that are currently configured.

- Delete spend rules config API endpoint: This new DELETE API endpoint should be used when spend rules need to be removed that are currently configured on a card.

Unlike the PUT spend rules API endpoint, when using the new create and update spend rules API endpoints, only the rules that you want to configure need to be provided. The rules that do not apply can be excluded. The delete spend rule API will remove all rules from the card specified.

Affected APIs:

PUT /managed_cards/\{id\}/spend_rulesPOST /managed_cards/\{id\}/spend_rulesPATCH /managed_cards/\{id\}/spend_rulesDELETE /managed_cards/\{id\}/spend_rules

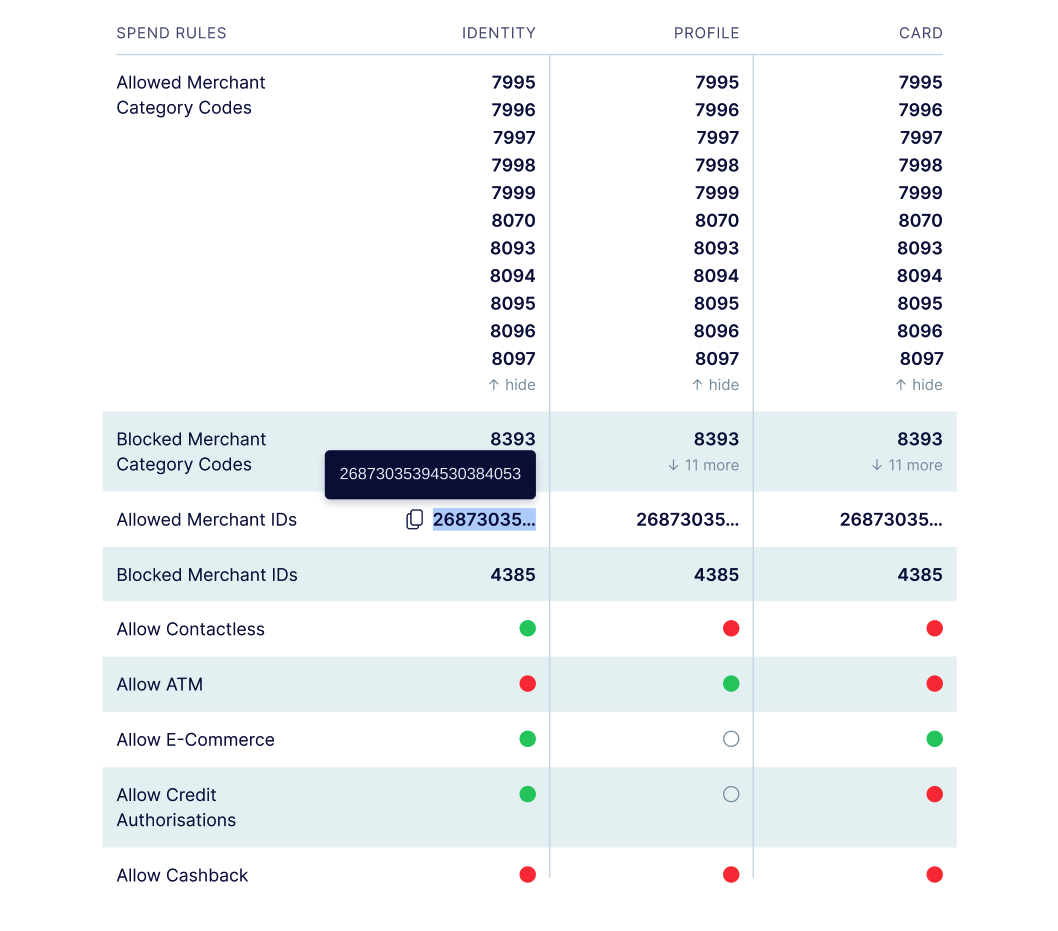

Retrieving Spend Rules

The current spend rules response combines all rules that apply. This response object will be deprecated and the Get Spend Rules API endpoint enhanced to contain three response objects (groupings):

- Card level spend rules: These are spend rules that are associated with the specific card itself

- Profile level spend rules: These are the spend rules that are configured in the Multi portal > Settings > Managed Cards screen.

- Identity level spend rules: These are spend rules that are associated with the cardholder (owner of the card).

Note that the response objects will only contain rules that have been configured within its group, thereby omitting all un-configured rules.

Innovator portal Spend Rules configuration screen

An enhanced UI card details screen will be provided, allowing viability of all spend rules associated with a card; allocated by each of the three object groups.

Affected Multi APIs:

/managed_cards/\{id\}/spend_rules

Affected Back office APIs:

/managed_cards/\{id\}/spend_rules

Deposit Transaction Fee Incorporation

As you are aware, it is possible to configure a fee for each deposit registered on a managed account - Managed Account Fees.

In order to maintain compliance with regulations, the way a deposit transaction value is reflected in the “GET a managed account statement” API response and “Account Deposit” webhook message, will be refined.

The transaction amount of the deposit will be inclusive of any applicable fee amount, representing the initial amount deposited (before fee collection).

The fee value itself will continue to be shared in the transactionFee field, and this content is not changing.

Example

Current:

- A £100.00 deposit with a deposit fee of £2.00 shows as transactionAmount.amount = 9800 and transactionFee.amount = 200

After the change:

- A £100.00 deposit with a deposit fee of £2.00 will show as transactionAmount.amount = 10000 and transactionFee.amount = 200

Affected API:

GET /managed_accounts/\{id\}/statement

Affected webhook:

POST /managed_accounts/deposits/watch

Account & Card Activity Statement Refinement

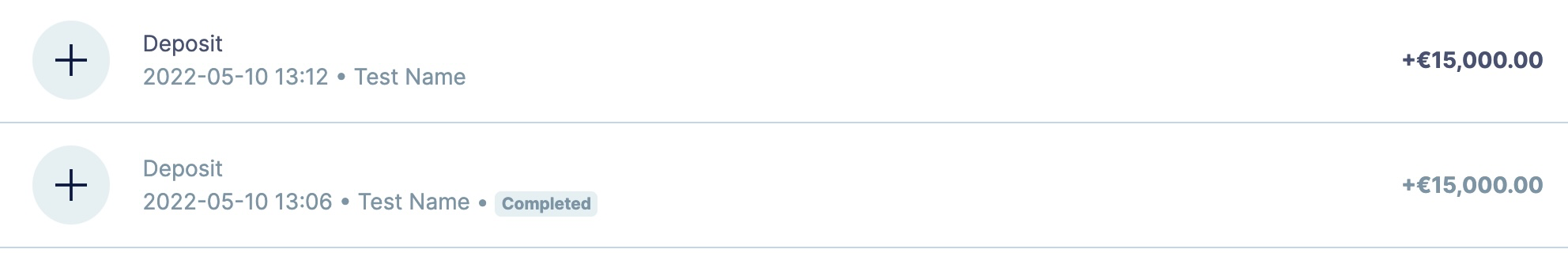

Currently two entries are returned on the activity statement screens for transactions such as deposits, original credit transactions, and the credit portion of a send. Display adjustments will differentiate these events and what they represent:

One record will represent the credit entry once the transaction is complete, with an amount in bold.

One record will represent the status of the transaction, with status either “Pending” or “Completed”, and an amount that is greyed-out.

Example deposit transaction:

Managed Account - PDF Statements

A new option will be available when retrieving a Managed Account Statement. The additional format of pdf will be supported for statement download.

The statement includes settled transactions only, for the range that you request. Pending transactions and authorisations will not be included on the pdf statement, but will continue to be returned in the json and csv formats, as well as continue to be displayed on the innovator portal as normal.

This improvement provides functionality to meet a regulatory requirement of providing the Managed Account owner with a statement in a 'durable medium', and should be added to your client offering.

To receive the statement as a pdf, send application/pdf in the accept Header Parameter.

API affected:

GET /managed_accounts/\{id\}/statement

Outgoing Wire Transfer (OWT) “Description” Validation

The description field within the "Create an OWT" API can be used for a payment reference or message to accompany a payment. This field is optional, but when completed, is passed to the ultimate beneficiary.

The validation on this field has been updated to match bank-transfer standards, maintaining compliance with receiving-banks, and ensuring an entered description can be processed. The length of the message depends on the type of OWT being created:

- SEPA and SWIFT = <=35 characters

- Faster Payments = <=18 characters

API affected:

- POST /outgoing_wire_transfers

Manual Transactions - New Webhook

A new webhook endpoint has been added, such that, In the event of a manual transaction adjustment occurring on an instrument, a webhook notification message will be automatically triggered that contains essential information on the action taken, ensuring systems remain in synch with Weavr.

The webhook message provides the ID, timestamp of the transaction, target instrument, as well as the relevant adjustment details, such as balance value.

Affected webhook:

- POST /manual_transactions/watch

Confirm Password UI Component

To strengthen the validation on password input during user onboarding, a new UI component called “confirm password” will be introduced. This confirm password component validates again the existing “password” component to ensure an exact match.

Read our Confirm Password UI Component guide on how to make use of this new capability in your product.

Removal of mobile uniqueness

It is no longer necessary for Authorised Users to have a unique mobile number. The email of the Authorised User must be unique but a mobile number can be used again for a different user.