Version 3.54.0

Changes in End Customer onboarding

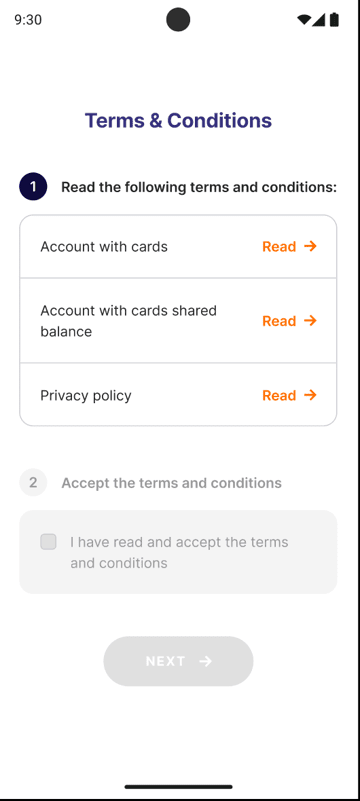

New FI T&Cs agreement onboarding screen

Onboarding flows for all new end customers will change to require an updated method of recording agreement to financial institution terms and conditions (FI T&Cs).

All Consumers and all Root Users of Corporates will now be shown the following screen when onboarding:

This enables us to record the agreement of the End Customer to the FI T&Cs directly, as well as automatically update the version of T&Cs if they are revised in future. T&Cs updates will be communicated in advance in each case.

This FI T&Cs agreement screen is implemented automatically in the standard embedded onboarding flows, prior to the Customer Due Diligence steps (e.g. identity verification and proof of address) in the rest of the process.

Live programmes will need to ensure that they remove any older T&Cs agreement steps from their own sign up flows (i.e. to remove duplication of a step) as soon as feasible. Embedders should still ensure the correct versions of the T&Cs documents are available to the End Customer to find easily via their application, support docs etc.

Documentation links:

Existing End Customers on live programmes will not be affected (since they already agreed to terms and conditions when they signed up, and were sent any subsequent changes).

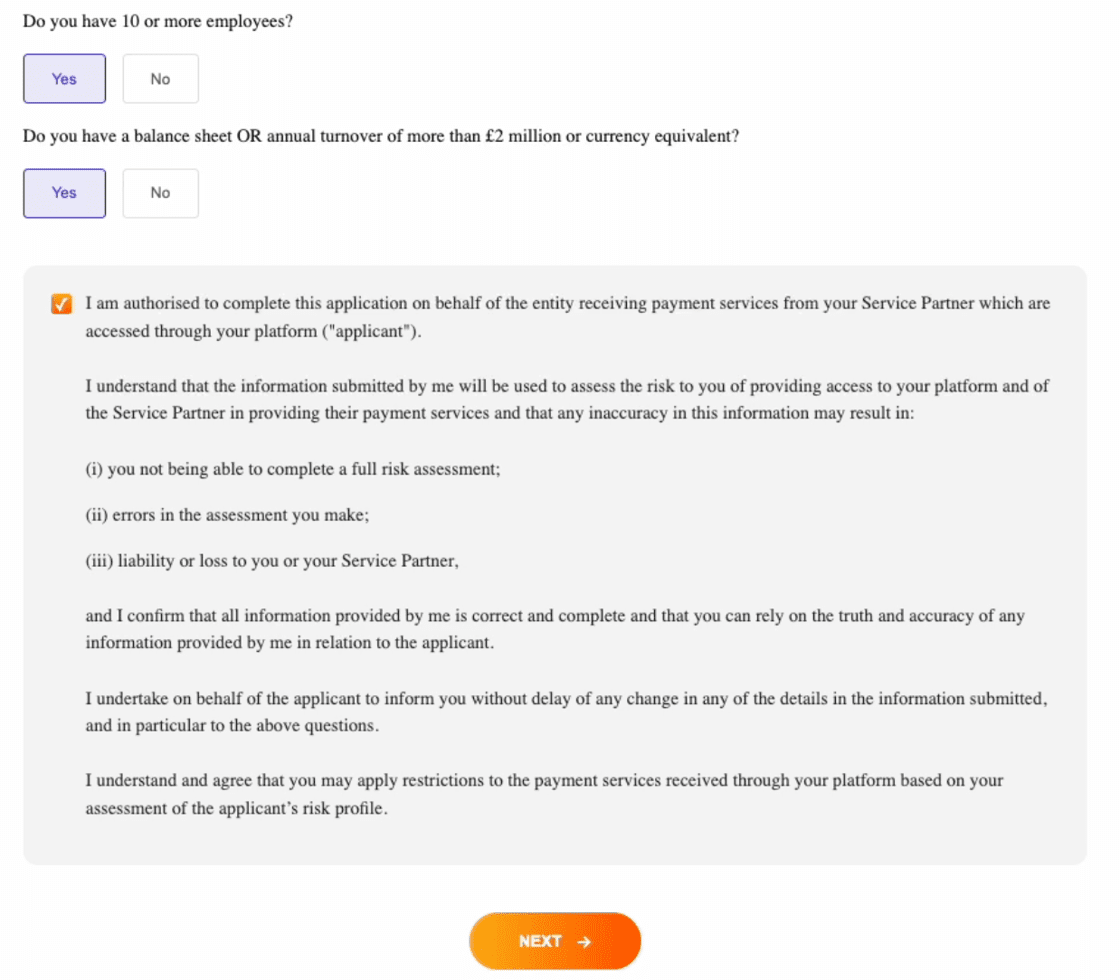

Updated/moved Micro-enterprise declaration in KYB onboarding

As well as the above new T&Cs step for all onboarding flows, we will now require a clearer Micro-enterprise declaration, which we are adding into the KYB onboarding:

As shown, the Root User of the Corporate needs to answer the two questions and then agree to the declaration about whether the Corporate is or is not considered a Micro-enterprise.

This replaces the previous question in the KYB questionnaire, and these changes take place automatically.

Documentation links:

Existing End Customers on live programmes will not have to take any action directly. If our records show that a Corporate’s profile is unclear about their Micro-enterprise status, we will follow up with the Embedder’s team about how to refresh KYB profiles in this respect.

Changes relating to wire transfers functionality in UK programmes

From 7 Oct 2024, new regulations come into force in the UK regarding the fraud compensation rights of retail customers using Faster Payment System payments, known in the industry as “push payments”, and hence the regulations relate to “authorised push payment fraud” or APP Fraud.

Embedders with UK programmes should familiarise with the following background information: APP Fraud overview. Pay UK provides a timeline of regulatory changes here.

All UK programmes now choose a general payment model that takes into account changes to risk from APP Fraud regulations, and as part of these changes we are also implementing new features to be able to exclude “self-to-self” payments from the scope of future fraud claims.

These APP Fraud related changes do not affect EU/EEA programmes.

UK programme choices under new APP Fraud compensation regime

UK programmes will now be classified into three distinct approaches in terms of how APP Fraud risks are mitigated.

-

Cards-Focused programmes

End Customers will not be able to send or receive Faster Payment System wire transfers except “self-to-self” to/from Linked Accounts, i.e. for the purpose of funding accounts for cards usage, and withdrawing any surplus balance.

-

Cards and Wire Transfers programmes

End Customers will continue to take advantage of GBP OWTs to third parties and IWTs from third parties via the Faster Payment System, but within new boundaries and features designed to control risk.

-

Wire Transfers Focused programmes

The Embedded Payment Run solution operates without cards and requires mitigations of APP Fraud risk: details for relevant programmes are available in separate release notes.

For (1) Cards-Focused programmes, changes must be made to implement Linked Accounts (see below) and remove any previous functionality and UI/UX material relating to third party OWTs and IWTs.

For (2) Cards and Wire Transfers programmes, changes include implementing new steps in OWT flows, optionally making use of Linked Accounts features, and establishing a working position with regard to real-time screening of IWTs.

All live UK programmes will receive more detailed guidance to assist with change management.

Introducing Linked Accounts

Linked Accounts are a new feature available initially for UK programmes only.

Linked Accounts are a representation of an End Customer’s own external accounts (such as a Corporate’s business bank account) which they register and verify in our systems. This means we can treat Incoming Wire Transfers from the external account as a “self-to-self” funding transaction, and any Outgoing Wire Transfer back out to that account as a “self-to-self” withdrawal.

These transactions are then not in scope of APP Fraud claims, ensuring that a [UK] Cards-Focused programme can operate without exposure to risk from general third-party wire transfer flows. In the case of [UK] Cards and Wire Transfer programmes, Linked Accounts can optionally be used to reduce risk by differentiating clearly between “self-to-self” flows and other third-party payments.

In summary:

- Both Consumer and Corporate End Customers on UK programmes can use Linked Accounts

- Using Linked Accounts is mandatory on UK Cards-Focused programmes

- Using Linked Accounts is optional on UK Cards & Wire Transfers programmes

- Linked Accounts are not yet available for EU/EUR/SEPA programmes

Existing End Customers on live UK Cards-Focused programmes will need to set up at least one Linked Account to be able to continue funding their payments (and withdrawing surplus funds if they desire). Weavr will assist live Embedders with this setup process for existing customers.

Documentation links:

- UK Linked Accounts: how to add and verify

- UX flow for registering and verifying a new Linked Account: flow diagram

Conditional acceptance of IWTs

We are offering the following new feature initially only for UK Cards and Wire Transfers programmes. In these programmes Embedders have opted to continue offering features that allow End Customers to receive Faster Payment System [GBP] IWTs from third parties. Therefore, both the End Customer and the Embedder are exposed to risk due to the possibility of external payers being retail customers who create a claim against a transaction with their (third-party / external) payer’s PSP.

On a beta basis we are working with affected programmes to put in place a real-time decisioning system so that the Embedder’s business can selectively decide on a per-transaction basis whether to allow an End Customer to accept a [GBP FPS] IWT.

This is described in our documentation as “IWT Forwarding Event” here.

We will discuss implementation details on a programme basis.

This feature is not available for Embedders on UK Cards-Focused programmes, although we use our own real-time decisioning in a similar way to reject IWTs which are not from external sources previously verified as Linked Accounts.

The feature does not currently apply to EU/EEA programmes and [EUR] SEPA payments.

Changed requirements for UK FPS OWT creation to include Confirmation of Payee

We are offering the following new mandatory change for UK Cards and Wire Transfers programmes, i.e. where End Customers are offered workflows to create [GBP FPS] OWTs to third-party payees.

Affected programmes will need to make changes to the UX and logic of their OWT workflow to incorporate a Confirmation of Payee check, and ensure the results are displayed intelligibly to the End Customer, so they can decide whether to proceed with the payment (or amend or cancel it).

This new OWT flow splits the API calls so that the Weavr system can provide the CoP check result and await a confirmation from the end customer’s decision to proceed, which is followed by the SCA challenge.

This implementation of Confirmation of Payee must be ready for End Customers to use (as the only OWT flow available for GBP FPS) by 31 October 2024.

We will support Embedders making changes in live programmes to ensure the implementation is compliant and well-designed for end users to understand.

Documentation links:

- Overview of Confirmation of Payee (applies to GBP FPS OWTs)

- Contact us for further documentation on the API and UX flow logic of OWT flows when implementing these changes

- Table of CoP responses and what to display to End Customers

Note Confirmation of Payee does not apply to EU/EEA programmes and [EUR] SEPA payments, but a similar solution (Verification of Payee) will come into force in the second half of 2025.

Recommended implementation of withdrawal OWTs to Linked Accounts

As noted above, UK Cards-Focused programmes will not be able to offer OWTs to End Customers except as “self-to-self” withdrawals to external accounts registered and verified as Linked Accounts. Applications in these programmes should not offer End Customers information or UX flows related to making OWTs to third parties.

Live UK programmes which previously offered OWT functionality and are now deprecating it should offer a revised UX flow for an End Customer creating a withdrawal transaction. The End Customer should be able to select one of their Linked Accounts as the payee, without being asked to edit the payee details.

Contact us for specific documentation on the API and UX flow logic of withdrawal OWTs to Linked Accounts.