Multi API v3.27.0

SEPA Instant wire transfersWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP).

Wire transfersWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP). made within the European SEPA network will now use SEPA Instant Credit TransferTransfer A transaction that moves funds between instruments managed by Weavr. The source and destination instruments of a transfer transaction must be owned by the same identity. Transfers can be scheduled for future execution and can be performed in bulk operations. (SCT Inst – hereafter “SEPA Instant”) if the receiving bank supports this payment method.

Here are some more details:

-

Outbound wire transfersWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP). up to €15k will automatically be routed via SEPA Instant, subject to an automatic check that the receiving bank/FI supports it.

-

In cases where the receiving bank/FI does not support SEPA Instant, the payment will automatically fall back to normal SEPA and continue successfully, all else being correct.

-

SEPA Instant provides payment rails that are available 24/7 and 365 days per year.

-

Existing features and procedures of SEPA payments remain the same (such as EUR currency, SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). two-factor authentication requirement).

There are no additional charges for our customers to use SEPA Instant compared to the previous standard SEPA wire transferWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP). fees. Enjoy!

View SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). enrolments and challenge history in the Innovator Portal

You can now view the SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). enrolment status of your Corporate and Consumer users, directly from the Innovator portal.

All SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). challenge activity and history initiated by your users can also be tracked in the Innovator portal user’s details screen.

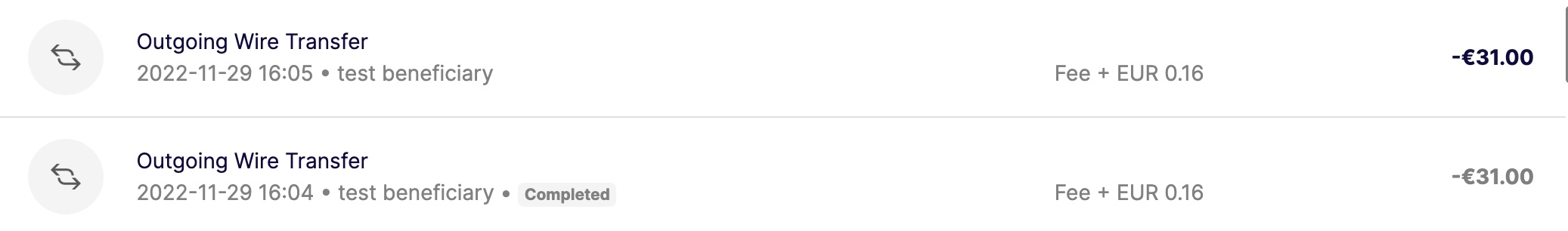

Duplicated OWTsOWT Outgoing Wire Transfer - a transaction that moves funds from a Weavr managed account to a bank account held at a third-party financial institution. OWTs require the managed account to have an assigned IBAN and the user to complete Strong Customer Authentication. in statement

This change addresses a bug where OWTsOWT Outgoing Wire Transfer - a transaction that moves funds from a Weavr managed account to a bank account held at a third-party financial institution. OWTs require the managed account to have an assigned IBAN and the user to complete Strong Customer Authentication. appeared to be duplicated on the Managed AccountManaged Account An account held at a financial institution that can be created and managed through the Weavr platform. Each account has a balance where customers can hold funds. Optionally, an IBAN can be assigned to enable wire transfers to bank accounts outside of Weavr. Activity Statement in the portal.

The purpose of the two entries has now been made clear. One record shows the status of transaction, and the other record indicates when the debit entry has been made, reducing the account’s actual balance.

Example of how an OWTOWT Outgoing Wire Transfer - a transaction that moves funds from a Weavr managed account to a bank account held at a third-party financial institution. OWTs require the managed account to have an assigned IBAN and the user to complete Strong Customer Authentication. is shown at various stages:

OWTOWT Outgoing Wire Transfer - a transaction that moves funds from a Weavr managed account to a bank account held at a third-party financial institution. OWTs require the managed account to have an assigned IBAN and the user to complete Strong Customer Authentication. submitted and being processed:

OWTOWT Outgoing Wire Transfer - a transaction that moves funds from a Weavr managed account to a bank account held at a third-party financial institution. OWTs require the managed account to have an assigned IBAN and the user to complete Strong Customer Authentication. completed (funds sent from source instrument):

Data Insights Managed Outgoing TransfersTransfer A transaction that moves funds between instruments managed by Weavr. The source and destination instruments of a transfer transaction must be owned by the same identity. Transfers can be scheduled for future execution and can be performed in bulk operations. dashboard enhancement

Data Insights offers you the possibility to analyse your outgoing wire transfersWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP). via the Managed AccountsManaged Account An account held at a financial institution that can be created and managed through the Weavr platform. Each account has a balance where customers can hold funds. Optionally, an IBAN can be assigned to enable wire transfers to bank accounts outside of Weavr. Outgoing TransferTransfer A transaction that moves funds between instruments managed by Weavr. The source and destination instruments of a transfer transaction must be owned by the same identity. Transfers can be scheduled for future execution and can be performed in bulk operations. dashboard. We have now enhanced the dashboard by including transferTransfer A transaction that moves funds between instruments managed by Weavr. The source and destination instruments of a transfer transaction must be owned by the same identity. Transfers can be scheduled for future execution and can be performed in bulk operations. type details to be able to distinguish between the different transferTransfer A transaction that moves funds between instruments managed by Weavr. The source and destination instruments of a transfer transaction must be owned by the same identity. Transfers can be scheduled for future execution and can be performed in bulk operations. types at transaction level.

Updates to the charge fees and access token back-office APIs

A new /fees/charge endpoint has been added to the back-office API that replaces both the consumer and corporate charge fee endpoints.

A new /access_token endpoint has been added to the back-office API that replaces the /impersonate_identity_login.

Note that the following back-office APIs have been marked as deprecated:

-

corporatesCorporates Business entities that can be onboarded as identities on Weavr. Corporate identities represent companies and require Know Your Business (KYB) verification. They can have multiple authorised users and issue cards to card assignees./fees/charge

-

consumersConsumers Individual persons who can be onboarded as identities on Weavr. Consumer identities represent individual customers and require Know Your Customer (KYC) verification. For consumers, the card owner and card assignee are typically the same person./fees/charge

-

impersonate_identity_login