Multi API v3.51.0

New Bulk processing capabilities in the MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. API

This new feature is available to try out, on request (via support ticket or your account manager).

End-customer businesses (i.e. CorporatesCorporates Business entities that can be onboarded as identities on Weavr. Corporate identities represent companies and require Know Your Business (KYB) verification. They can have multiple authorised users and issue cards to card assignees.) often have to perform certain actions in bulk or batches. For example when an employer enrols their employees into their benefits programme. In such cases, the EmbedderEmbedder A company or developer that integrates Weavr's embedded finance services into their own application to provide financial services to their end customers.�’s application can call a MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. endpoint for each individual end user action, as many times as necessary. We are now providing built-in bulk processing capabilities to make this type of repetitive/batch action easier to run and monitor.

Bulk operationsBulk Operations The capability of grouping multiple individual API-based actions into a batch. Bulk operations allow you to execute hundreds or thousands of operations by making only one or two API calls, increasing throughput, accomplishing actions in a secure session, and reducing complexity in your application. refers to the capability of grouping multiple individual API-based actions into a batch. Over time we will make available an increasing range of common actions as bulk operationsBulk Operations The capability of grouping multiple individual API-based actions into a batch. Bulk operations allow you to execute hundreds or thousands of operations by making only one or two API calls, increasing throughput, accomplishing actions in a secure session, and reducing complexity in your application..

Running a bulk operation creates a Bulk ProcessBulk Process A task created when initiating a group of bulk operations. The Bulk Process has a consistent lifecycle (statuses) and management method, regardless of the type of operation being performed. It can be in states such as SUBMITTED, RUNNING, PAUSED, CANCELLED, or completed states., which is a parent task representing the workload, with a lifecycle (statuses) and management method. We aim to make this manageable in a consistent way regardless of the type of operation being performed in different or concurrent processes.

The first bulk operationsBulk Operations The capability of grouping multiple individual API-based actions into a batch. Bulk operations allow you to execute hundreds or thousands of operations by making only one or two API calls, increasing throughput, accomplishing actions in a secure session, and reducing complexity in your application. we’re making available are:

-

POST

bulks/usersBulk create Corporate Authorised Users -

POST

bulks/user/_user_id_/inviteBulk invite Corporate Authorised Users -

POST

bulks/managed_cards/_id_/spend_rulesBulk update spend rules across Managed CardsManaged Card A payment card (virtual or physical) that can be created and managed through the Weavr platform. Cards can operate in prepaid mode (with their own balance) or debit mode (linked to a managed account). All cards must be assigned to a card assignee who is an Authorised User.

See our documentation for full details of the underlying MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. API calls.

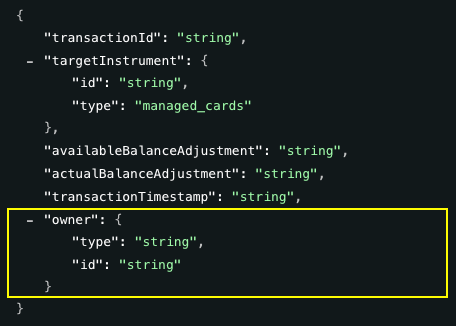

Owner details added to the manual transaction Webhook event

Previously for EmbedderEmbedder A company or developer that integrates Weavr's embedded finance services into their own application to provide financial services to their end customers. programme developers or technical administrators that enabled Weavr Webhook API, the manual transaction webhook event provided information relating to the transaction and the financial Instrument, but the Instrument owner's details were not included.

We’re now including the Instrument owner's details in the manual transaction event webhook. The owner details will include the type (whether corporate or consumer) and the owner ID.

This means that the additional data (the owner ID) can be used to reconcile all manual transactions impacting a single customer. This update will be made available automatically upon release and visible once a manual transaction webhook event is received.

Additional measure to avoid shared mobile device for biometrics

Currently, for a device that has been enrolled for biometrics, it is possible to fully log-out, and then a different user use the same device to log-in. It is already not possible to enrol the same device for two users, and so a secondary user in that scenario would be able to log in, but then not be permitted to access functions requiring a Stepped-Up token.

We are closing this edge case to strengthen the security of our biometrics SDK: once the device is enrolled, it can only be used for logins by the unique end user who set up biometrics. For anyone else to use that device for their own logins to the EmbedderEmbedder A company or developer that integrates Weavr's embedded finance services into their own application to provide financial services to their end customers.'s application, it would need to be unenrolled by the first end user (thus freeing it up to be enrolled into biometrics by a different user).

Updated word separator in Embedder PortalEmbedder Portal A web-based portal where embedders can access their Weavr account, manage API credentials, configure settings, view dashboards, and access documentation. The portal provides access to both sandbox and production environments, with separate credentials for each. URLs

In the process of standardising URL structure in the Embedder PortalEmbedder Portal A web-based portal where embedders can access their Weavr account, manage API credentials, configure settings, view dashboards, and access documentation. The portal provides access to both sandbox and production environments, with separate credentials for each. we have replaced underscores (_) with hyphens (-) in paths of:

/programmes/:programmeId/console/

Example:

managed_accounts->managed-accountsmanaged_cards->managed-cards

All navigation paths should work as usual, and old URLs the EmbedderEmbedder A company or developer that integrates Weavr's embedded finance services into their own application to provide financial services to their end customers.'s team have bookmarked should redirect to the new URLs. Contact us if you spot anything that's not working as expected in the Embedder PortalEmbedder Portal A web-based portal where embedders can access their Weavr account, manage API credentials, configure settings, view dashboards, and access documentation. The portal provides access to both sandbox and production environments, with separate credentials for each. interfaces.

FATCA reporting for US citizens and residents

Note that we are required to report details of any USA citizen/resident account holders under Foreign Account Tax Compliance Act (FATCA) regulations. This applies to Directors or Beneficial Owners of CorporatesCorporates Business entities that can be onboarded as identities on Weavr. Corporate identities represent companies and require Know Your Business (KYB) verification. They can have multiple authorised users and issue cards to card assignees. as well as to ConsumersConsumers Individual persons who can be onboarded as identities on Weavr. Consumer identities represent individual customers and require Know Your Customer (KYC) verification. For consumers, the card owner and card assignee are typically the same person.. We will contact you if this affects your live programme.

If you are planning to expand the addressable market of end customers onboarding to your application, whether for US-based customers or other geographic expansion, discuss with your Weavr account manager (or open a support ticket) to confirm possibilities and any additional processes required.