Multi API v3.55.0

Linked AccountsLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. - further details for End Customer support

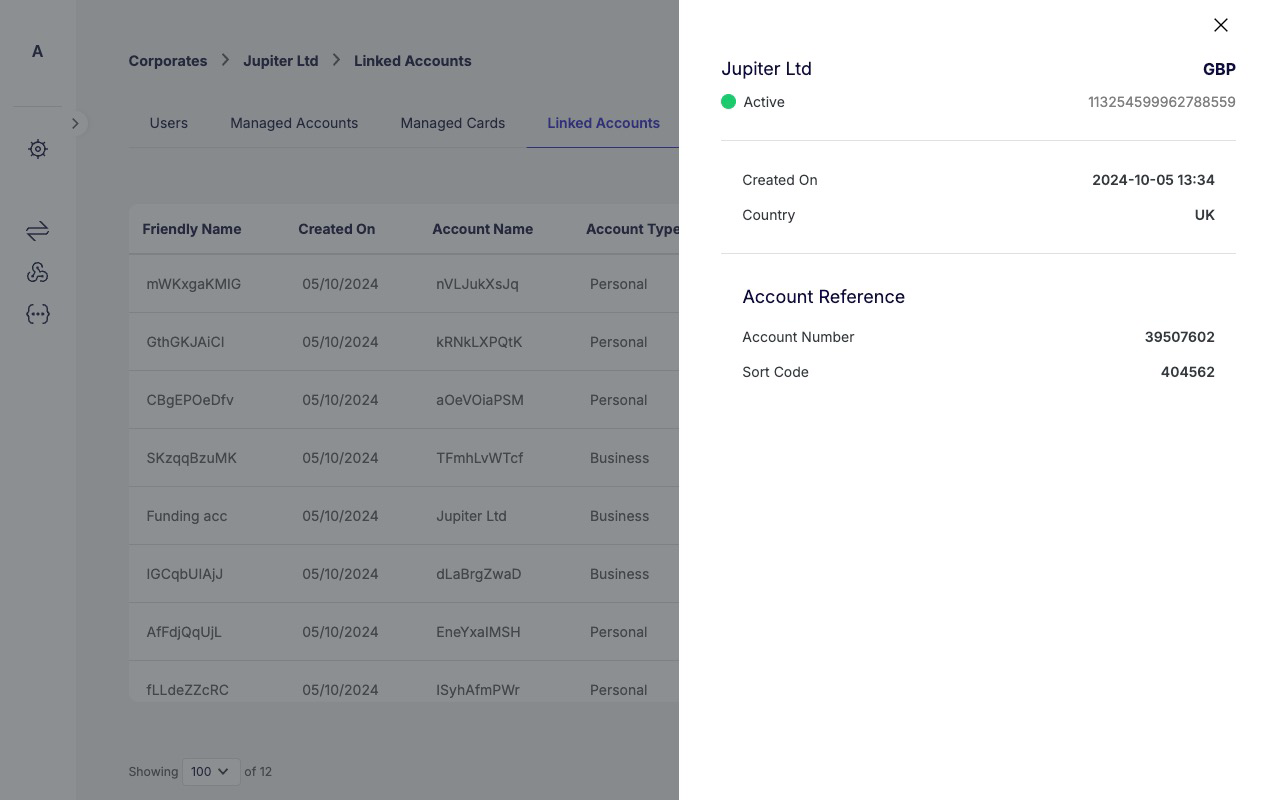

EmbedderEmbedder A company or developer that integrates Weavr's embedded finance services into their own application to provide financial services to their end customers. staff can find a list of all of a (Corporate) End Customer’s Linked AccountsLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. in the Embedder PortalEmbedder Portal A web-based portal where embedders can access their Weavr account, manage API credentials, configure settings, view dashboards, and access documentation. The portal provides access to both sandbox and production environments, with separate credentials for each.. In this interface we have added to the information panel to include the sort code and account number of the external account, to be used by EmbedderEmbedder A company or developer that integrates Weavr's embedded finance services into their own application to provide financial services to their end customers. staff for supporting End Customers with any queries.

We have also added a new data dashboard in the Embedder PortalEmbedder Portal A web-based portal where embedders can access their Weavr account, manage API credentials, configure settings, view dashboards, and access documentation. The portal provides access to both sandbox and production environments, with separate credentials for each. to support the review and analysis of Linked AccountsLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers.. This shows EmbedderEmbedder A company or developer that integrates Weavr's embedded finance services into their own application to provide financial services to their end customers. staff key metrics to help with proactive troubleshooting of End Customer Linked AccountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. setup processes:

The Linked AccountsLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. data dashboard also features a funnel chart that visualises the Linked AccountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. setup journey, showing the various steps which have to be completed.

Additionally, we have updated the SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). Events dashboard to include Linked AccountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. IDs within the Details table for more comprehensive tracking.

You can find out more about Linked Accounts in our documentation here.

Data insights on Micro-enterprises

Programmes onboarding and servicing UK CorporatesCorporates Business entities that can be onboarded as identities on Weavr. Corporate identities represent companies and require Know Your Business (KYB) verification. They can have multiple authorised users and issue cards to card assignees. are required to track whether the End Customer business is a Micro-enterprise. We have added a new filter and charts to the CorporatesCorporates Business entities that can be onboarded as identities on Weavr. Corporate identities represent companies and require Know Your Business (KYB) verification. They can have multiple authorised users and issue cards to card assignees. data insights dashboard in the Embedder PortalEmbedder Portal A web-based portal where embedders can access their Weavr account, manage API credentials, configure settings, view dashboards, and access documentation. The portal provides access to both sandbox and production environments, with separate credentials for each. to help EmbedderEmbedder A company or developer that integrates Weavr's embedded finance services into their own application to provide financial services to their end customers. staff manage Micro-enterprises in their programme, if applicable.

Filter Managed CardsManaged Card A payment card (virtual or physical) that can be created and managed through the Weavr platform. Cards can operate in prepaid mode (with their own balance) or debit mode (linked to a managed account). All cards must be assigned to a card assignee who is an Authorised User. by renewal type

Weavr offers two options in regards to renewal when a card reaches expiry: RENEW and NO_RENEW. For more information see the Card Renewals section in our documentation.

We have added renewalType as an option on the GET Managed CardsManaged Card A payment card (virtual or physical) that can be created and managed through the Weavr platform. Cards can operate in prepaid mode (with their own balance) or debit mode (linked to a managed account). All cards must be assigned to a card assignee who is an Authorised User. endpoint to allow you to filter the results by cards that are set to either RENEW or NO_RENEW.

Effected endpoint: GET /managed_cards

Webhooks for more granular KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers./KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. status changes

We have enhanced existing webhook functionality for tracking KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. and KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. process states to include webhooks when additional information is required at a certain step, so that the application cannot proceed until something is added or revised.

Weavr will now sendSend A transaction type that allows sending funds to another identity's instrument or to a beneficiary. Send transactions may require Strong Customer Authentication depending on the destination and whether it's a trusted beneficiary. webhooks at all of these stages: initiation, pending review, temporary rejection (indicated by an ‘Initiated’ status), and approval or rejection.

In the details passed with the webhook, we may supply a rejection reason (e.g. CorporateKybFailureReason - see API documentation) and there may be a customer-specific message from the support agent.

Affected webhooks:

- Corporate KYB status update

- Corporate beneficiary status update (NB 'beneficiaryBeneficiary A trusted recipient for payments that includes both information about the business or individual as well as their bank account or instrument details. When using trusted beneficiaries, customers may be allowed to skip Strong Customer Authentication (SCA) when executing Outgoing Wire Transfer or Send transactions, reducing the number of approval steps required.' here relates to UBOs in the KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. process)

- Consumer KYC status update

Prevention of duplicate Consumer Identity creation

We are strengthening controls to ensure that an individual can only be added once per programme, when creating a Consumer Identity.

If an attempt is made by the EmbedderEmbedder A company or developer that integrates Weavr's embedded finance services into their own application to provide financial services to their end customers. to create a new Consumer, and Weavr considers it’s a probable duplicate within that programme, we will reject with a new error code 409 CONSUMER_ALREADY_EXISTS