Breaking Change (March 2025) Open Banking Fallback - Manual Account Linking and Funding

We are introducing another way for your customers to link an account and fund their payment runsPayment Run A list of payments created by Buyers to settle their outstanding financial obligations with their suppliers. Payment runs are typically managed by the accounts payable function within a business on a periodic basis and go through stages of creation, authorisation, funding, and execution. to cover instances when their bank is not supported via Open BankingOpen Banking A service that allows customers to securely share their bank account information and authorize payments directly from their bank account. In Payment Run, Open Banking can be used to link accounts and fund payment runs, providing a seamless experience for buyers.. This initiative involves a breaking change to the current AIS and PIS UI Components.

Effective:

- 11 February 2025 on Sandbox

- 04 March 2025 on Live

Open BankingOpen Banking A service that allows customers to securely share their bank account information and authorize payments directly from their bank account. In Payment Run, Open Banking can be used to link accounts and fund payment runs, providing a seamless experience for buyers. Fallback - Link an Account

Users with the Controller role can now manually link their bank accounts, depending on the jurisdiction, without relying on Open BankingOpen Banking A service that allows customers to securely share their bank account information and authorize payments directly from their bank account. In Payment Run, Open Banking can be used to link accounts and fund payment runs, providing a seamless experience for buyers..

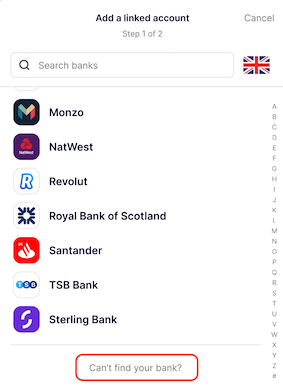

1. Updated UI component to include the manual option

To link an account manually, you can still load the current AIS UI Component, were the component has been updated to include a new URL, "Can't find your bank?" at the end of the UI Component as pictured below:

To support manual account linking in addition to Open BankingOpen Banking A service that allows customers to securely share their bank account information and authorize payments directly from their bank account. In Payment Run, Open Banking can be used to link accounts and fund payment runs, providing a seamless experience for buyers., we have renamed the AIS UI Component weavrComponents.prompt.ais to weavrComponents.prompt.linkAccount. This change ensures our UI component reflects its broader functionality and aligns with evolving user needs.

2. Entering the bank account details

When the "Can't find your bank?" option is selected, the user will be directed to a new screen where they must enter their bank account details. The following key fields will be required:

- Business Account Name: The registered owner’s name of the account at the external bank or PSP. This should match the name on the external account to ensure successful linkage and compliance with verification steps.

- Bank Name

- Bank Country: The country in which the bank or financial institution holding the account is located. This is essential for regulatory and compliance purposes.

- Account Information: The IBANIBAN International Bank Account Number - a standardized international bank account identifier. Managed accounts can be assigned an IBAN to enable wire transfers to and from bank accounts outside of Weavr. IBANs are required for EUR accounts and enable SEPA transfers. or the combination of the Account Number and Sort Code of the account at the external bank or PSP. This uniquely identifies the account within the financial institution and is necessary for processing transactions.

Once the bank account details are submitted, a Linked Account Update Webhook event will be triggered. This event will include the new id of the Linked AccountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. and its status will transition to PENDING_CHALLENGE.

3. Declaration of Ownership via SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). Challenge

Ensuring that the registered linked accountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. belongs to the Identity attempting to link it is crucial. As part of this process, declaration of ownership is conducted through a Strong Customer Authentication (SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics).) challenge, which must be completed by a user with the Controller role.

Upon initiating the Linked AccountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. registration, the Controller user must successfully complete the SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). challenge to confirm ownership.

After successful completion, a Linked Account Update Webhook event will be triggered updating the linked accountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. status to PENDING_FUNDING.

4. Control Check through a test funding Transaction

After successfully completing the SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). process, user must demonstrate control over the external account by performing a test funding transaction. The UI component will redirect the user to the final screen, displaying the following details:

- Amount to be sent

- Account number

- Sort Code

- Reference Code

This step is critical to verify that the registered identity controls the account. It is essential that users include the reference code in the funding transaction. Failure to complete the test funding transaction will result in the linked accountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. remaining in the PENDING_FUNDING state.

The funding transaction will not be needed for a Linked AccountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. linked via Open BankingOpen Banking A service that allows customers to securely share their bank account information and authorize payments directly from their bank account. In Payment Run, Open Banking can be used to link accounts and fund payment runs, providing a seamless experience for buyers..

Once the plugin receives and validates the test funding transaction a Linked Account Update Webhook event will be triggered, updating the linked accountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. status to LINKED.

Open BankingOpen Banking A service that allows customers to securely share their bank account information and authorize payments directly from their bank account. In Payment Run, Open Banking can be used to link accounts and fund payment runs, providing a seamless experience for buyers. Fallback - Fund a Payment RunPayment Run A list of payments created by Buyers to settle their outstanding financial obligations with their suppliers. Payment runs are typically managed by the accounts payable function within a business on a periodic basis and go through stages of creation, authorisation, funding, and execution.

Your users with the Controller role will be able to use the newly created manual linked accountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. to fund the payment runPayment Run A list of payments created by Buyers to settle their outstanding financial obligations with their suppliers. Payment runs are typically managed by the accounts payable function within a business on a periodic basis and go through stages of creation, authorisation, funding, and execution..

1. Updated UI component to allow funding using a manual linked accountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers.

To use the manually linked accountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers., the user can load the current PIS UI Component, were the component will have a new screen

To support funding of a payment runPayment Run A list of payments created by Buyers to settle their outstanding financial obligations with their suppliers. Payment runs are typically managed by the accounts payable function within a business on a periodic basis and go through stages of creation, authorisation, funding, and execution. with a linked accountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. in addition to Open BankingOpen Banking A service that allows customers to securely share their bank account information and authorize payments directly from their bank account. In Payment Run, Open Banking can be used to link accounts and fund payment runs, providing a seamless experience for buyers., we have renamed the PIS UI Component weavrComponents.prompt.pis to weavrComponents.prompt.paymentFund. This change ensures our UI component reflects its broader functionality and aligns with evolving user needs.

Breaking Change Updates

To make the UI component more generic and to support the Open BankingOpen Banking A service that allows customers to securely share their bank account information and authorize payments directly from their bank account. In Payment Run, Open Banking can be used to link accounts and fund payment runs, providing a seamless experience for buyers. fallback of the manual account linking and funding initiative, we have renamed the below UI Components:

- From weavrComponents.prompt.ais to

weavrComponents.prompt.linkAccount - From weavrComponents.prompt.pis to

weavrComponents.prompt.paymentFund

You will also need to start handling the new PENDING_FUNDING state. This state will be sent to you via an event in the UI component and in the Linked Account Update webhook event.

Action Required

Rename the UI Components as follows:

- From AIS UI Component to

Link Account UI Component - From PIS UI Component to

Payment Funding UI Component

If no action is taken

Although this is a small change, if no action is taken, you application will not be able to load the AIS and PIS UI Components accordingly, resulting in your customers not being able to link an account or fund a payment runPayment Run A list of payments created by Buyers to settle their outstanding financial obligations with their suppliers. Payment runs are typically managed by the accounts payable function within a business on a periodic basis and go through stages of creation, authorisation, funding, and execution..

More information and documentation will be shared with you closer to the breaking change date.