New Data Insights Dashboards in Embedder Portal

Data Insights is your go to Business Intelligence solution, providing you with near-real time dashboards that will help you in gathering insights, whilst empowering everyone in your company to explore data and make informed decisions. The dashboards are instantly available when setting your Embedded finance programme, on both your Sandbox and Production environments.

Effective:

- 12 August 2024 on Sandbox

- 14 January 2025 on Live

The purpose of these dashboards is to:

- allow users to access retrospective management reports, such as activity KPIs

- support the day-to-day management of programmes such as: a. monitoring for patterns or issues in general b. supporting individual end-customers proactively or reactively c. having a shared view of specific customers or transactions when working with Weavr 2nd/3rd tier support

- drill-down into segments to inspect more detail on individual items

Each dashboard provides focused views to help you in analysing your data, including:

- Overview: high-level overview of your main KPIs, including daily trends for the last 30 days

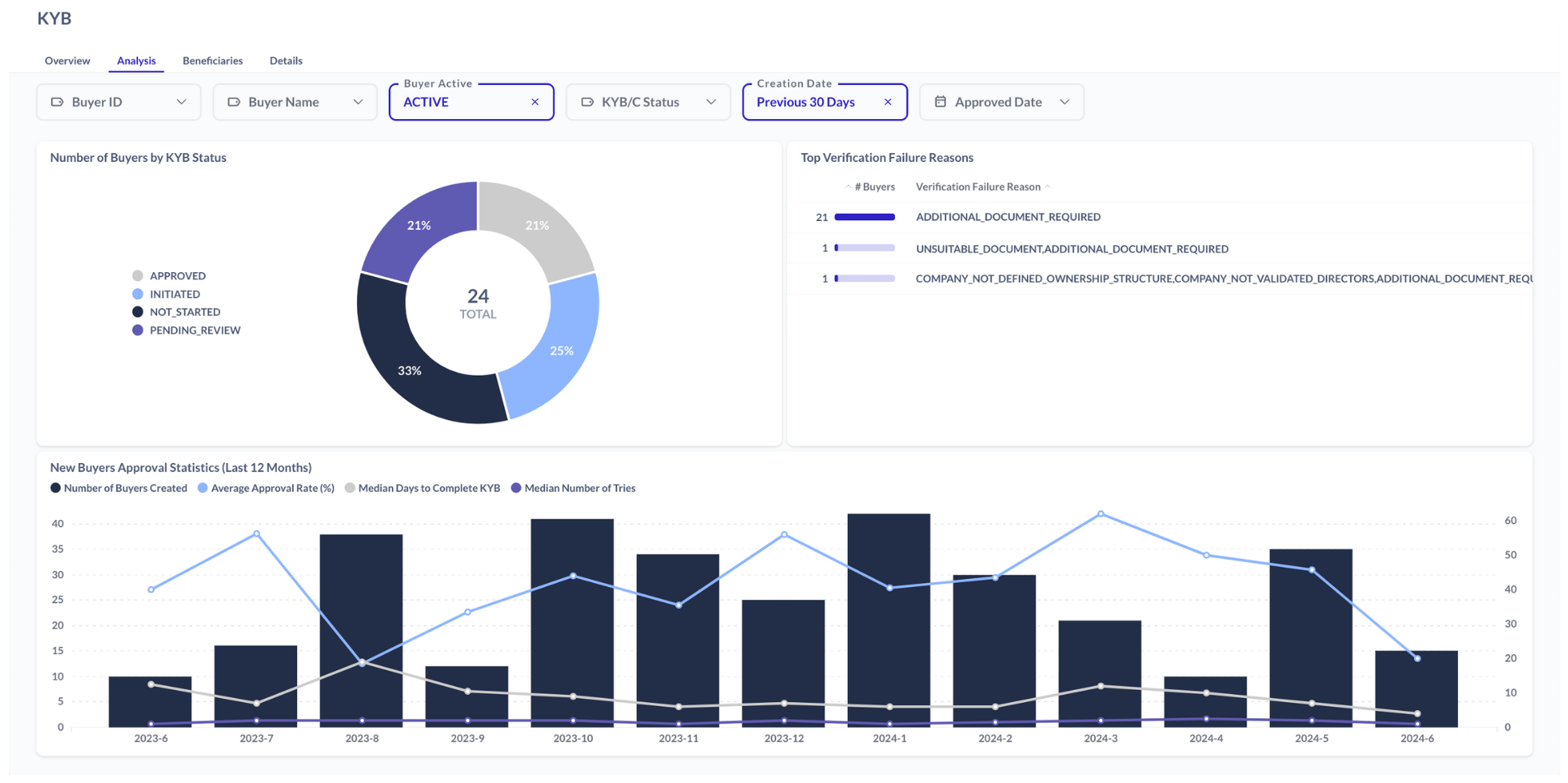

- Analysis: a set of charts that can be used to analyse better your consumersConsumers Individual persons who can be onboarded as identities on Weavr. Consumer identities represent individual customers and require Know Your Customer (KYC) verification. For consumers, the card owner and card assignee are typically the same person. and their activity

- Details: a detailed table, providing you with granular data at identity, instrument or transaction level

An informational tooltip is also available within each chart, providing definitions and granularity details pertaining to that chart. Additionally, drop-down filters can be used across all dashboards, making it easier to find what you are searching for.

To help you get started in understanding the main dashboards currently available on Data Insights, have a look at the table below:

| Description | |

|---|---|

| BuyerBuyer A business entity in the Payment Run solution that can be provided with financial services to perform embedded payment runs. Buyers are onboarded through a KYB process and can create payment runs to pay their suppliers. They have roles such as Admin, Controller, and Creator. | Insights on creation and status of new buyersBuyer A business entity in the Payment Run solution that can be provided with financial services to perform embedded payment runs. Buyers are onboarded through a KYB process and can create payment runs to pay their suppliers. They have roles such as Admin, Controller, and Creator. |

| KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. | Insights on the KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. process and beneficiaries |

| Payment RunPayment Run A list of payments created by Buyers to settle their outstanding financial obligations with their suppliers. Payment runs are typically managed by the accounts payable function within a business on a periodic basis and go through stages of creation, authorisation, funding, and execution. | Insights on payment runsPayment Run A list of payments created by Buyers to settle their outstanding financial obligations with their suppliers. Payment runs are typically managed by the accounts payable function within a business on a periodic basis and go through stages of creation, authorisation, funding, and execution. created by BuyersBuyer A business entity in the Payment Run solution that can be provided with financial services to perform embedded payment runs. Buyers are onboarded through a KYB process and can create payment runs to pay their suppliers. They have roles such as Admin, Controller, and Creator. to settle their outstanding financial obligations with their suppliersSupplier A trusted business or individual that receives payments from Buyers through payment runs. Suppliers can be stored in a trusted supplier list, and when marked as trusted, may allow Buyers to skip Strong Customer Authentication when executing payment runs to those suppliers. |

| Linked AccountLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. | Insights on linked accountsLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers., in order to fund payments within a payment runPayment Run A list of payments created by Buyers to settle their outstanding financial obligations with their suppliers. Payment runs are typically managed by the accounts payable function within a business on a periodic basis and go through stages of creation, authorisation, funding, and execution. |

| SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). | Insights on SCASCA Strong Customer Authentication - a two-factor authentication solution required by PSD2 regulations for when end-users are accessing their payment account sensitive information or initiating transactions. SCA requires at least two of the following: something you know (password), something you have (device), or something you are (biometrics). events, including details on when end-users are accessing their payment account information as well as initiating transactions |

| API Calls | Insights on API Requests |

Detailed documentation around Data Insights is also available within the knowledge base section of the Weavr support portal. This is also linked via the Help button within the Embedder PortalEmbedder Portal A web-based portal where embedders can access their Weavr account, manage API credentials, configure settings, view dashboards, and access documentation. The portal provides access to both sandbox and production environments, with separate credentials for each..

We’d like to hear your feedback about Data Insights. Speak with your Weavr contacts to share your ideas.