Consumer due diligence

ConsumersConsumers Individual persons who can be onboarded as identities on Weavr. Consumer identities represent individual customers and require Know Your Customer (KYC) verification. For consumers, the card owner and card assignee are typically the same person. that are being onboarded need to complete KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. (Know Your Customer) before they can use any financial service. Such ConsumersConsumers Individual persons who can be onboarded as identities on Weavr. Consumer identities represent individual customers and require Know Your Customer (KYC) verification. For consumers, the card owner and card assignee are typically the same person. are required to provide due diligence information.

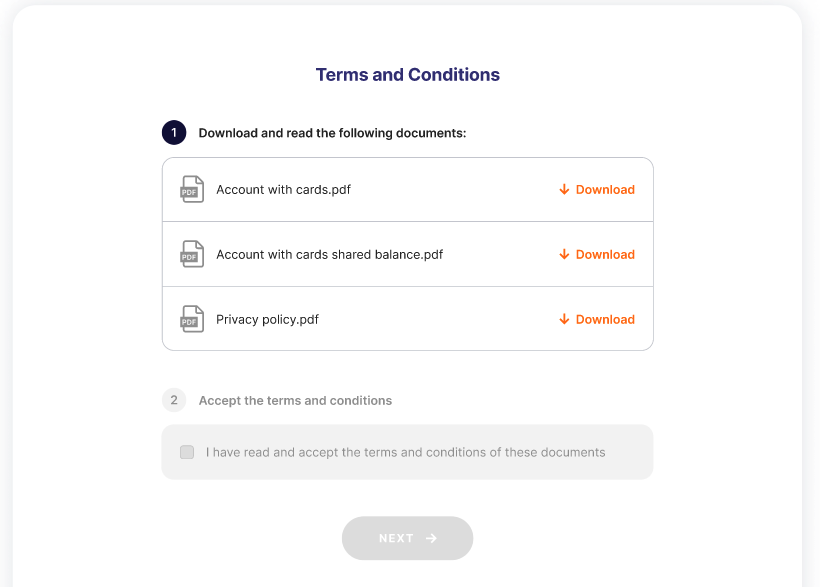

The first screen shown in the KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. UI component requires the Consumer to view and consent to the Terms and Conditions, before the actual due diligence process is initiated.

The following information is captured as part of the standard due diligence process:

- Identity document (e.g. copy of the ID card or passport)

- Liveness check (selfie)

- Proof of address (e.g. a recent copy of a utility bill or a bank statement)

The following documents are accepted as proof of address for individuals:

- Bank or card statements, mortgage, formal bank letters

- Utility bills (water, electricity)

- Internet/cable TV/house phone line bills

- Tax returns

- Council tax bills

- Driving licence showing the address

- Residence permit showing the address

- Official government-issued documentation, tax certificates, certifications, etc.

Provided documents must not be older than 3 months.

Retrieve the KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. status of a Consumer

In order to determine the KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. status of a Consumer, use

The fullDueDiligence field returns the KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. status for the consumer.