Simulator

Before you push your application to the Live environment, you should test your integration to make sure it handles flows correctly.

Use the simulator in your Sandbox MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. Portal to simulate processes and transactions that cannot be triggered by the integration alone such as a purchase on a card or a deposit on an IBANIBAN International Bank Account Number - a standardized international bank account identifier. Managed accounts can be assigned an IBAN to enable wire transfers to and from bank accounts outside of Weavr. IBANs are required for EUR accounts and enable SEPA transfers..

You can also build automated tests by triggering the simulator via the simulator API.

Identity Verification

After you register a corporate or a consumer identity, you can simulate the approval of their KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. or KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. verification.

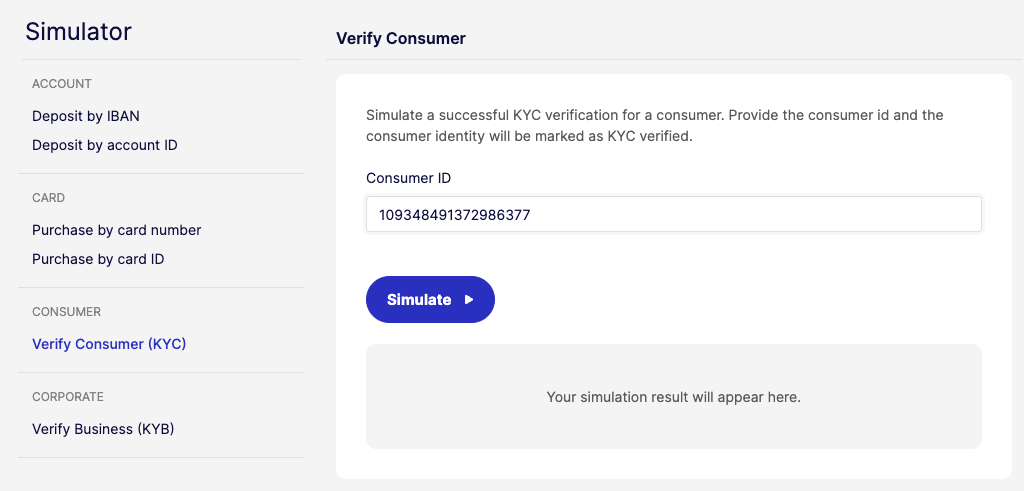

Consumer Identity KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. Verification

When you create a consumer identity, the KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. status of the identity fullDueDiligence is NOT-STARTED. To lift identity restrictions and change fullDueDiligence to APPROVED, you can simulate KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. verification as follows:

Using the Simulator API

# Replace $WEAVR_API_KEY with your API key found on the API Credentials page in the Multi Portal.

# Replace $CONSUMER_ID with the value of the `id.id` field of the response object returned when you created the consumer identity.

curl --location --request POST 'https://sandbox.weavr.io/simulate/api/consumers/{{$CONSUMER_ID}}/verify' \

--header 'Content-Type: application/json' \

--header 'programme-key: {{$WEAVR_API_KEY}}' \

--data-raw '{}'

Using the Simulator UI

- Log in to the Multi Sandbox Portal using your credentials.

- Navigate to Simulator > Verify Consumer (KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers.).

- Input the consumer ID that you would like to KYCKYC Know Your Customer - the identity verification process for consumer identities. This process allows you to seamlessly and securely verify your user's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. verify and click on Simulate.

You can find the consumer ID of a consumer identity in the MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. Portal by navigating to Home > Consumer Details.

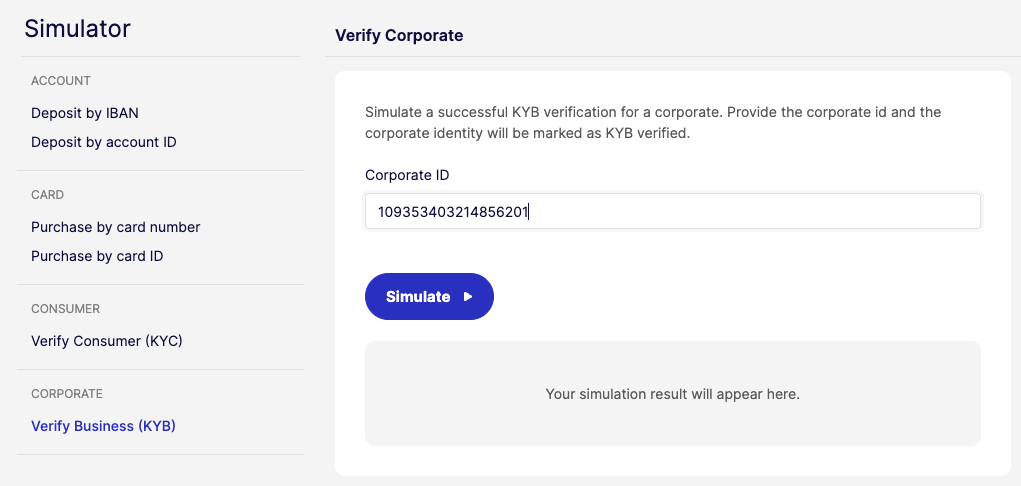

KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. Verification

When you create a corporate identity, the KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. status of the identity fullCompanyChecksVerified is NOT-STARTED. To lift identity restrictions and change fullCompanyChecksVerified to APPROVED, you can simulate KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. verification as follows:

Using the Simulator API

# Replace $WEAVR_API_KEY with your API key found on the API Credentials page in the Multi Portal.

# Replace $CORPORATE_ID with the value of the `id.id` field of the response object returned when you created the corporate identity.

curl --location --request POST 'https://sandbox.weavr.io/simulate/api/corporates/{{$CORPORATE_ID}}/verify' \

--header 'Content-Type: application/json' \

--header 'programme-key: {{$WEAVR_API_KEY}}' \

--data-raw '{}'

Using the Simulator UI

- Log in to the Multi Sandbox Portal using your credentials.

- Navigate to Simulator > Verify Corporate (KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers.).

- Input the corporate ID that you would like to KYBKYB Know Your Business - the identity verification process for corporate identities. This process allows you to seamlessly and securely verify your business customer's identity. Weavr will ask users to submit the necessary information and documentation so that they can get approved by financial providers. verify and click on Simulate.

You can find the corporate ID of a corporate identity in the MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. Portal by navigating to Home > Corporate Details.

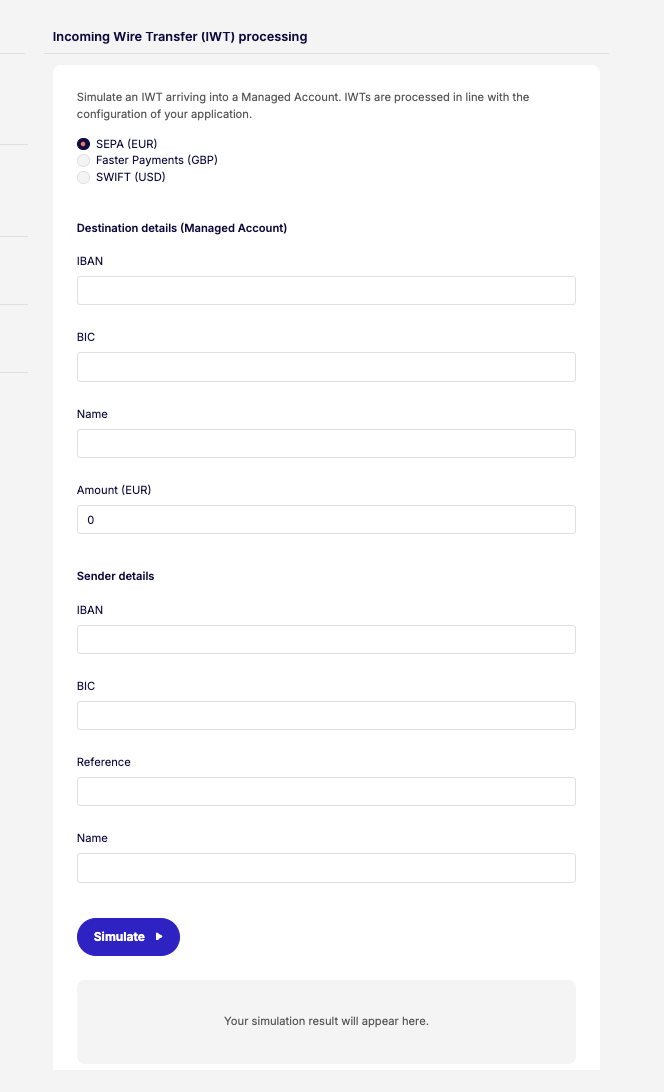

Incoming Wire TransferWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP).

Managed accounts that have an IBANIBAN International Bank Account Number - a standardized international bank account identifier. Managed accounts can be assigned an IBAN to enable wire transfers to and from bank accounts outside of Weavr. IBANs are required for EUR accounts and enable SEPA transfers. (EUR or USD) or a sort code and account number (GBP) can receive incoming wire transfersWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP). from an external bank account.

When Weavr receives a new incoming wire transfer, it is processed according to the configuration of your application, based on the financial services your embedded finance programme supports.

Various scenarios can be simulated from the "Incoming Wire TransferWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP). (IWTIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds.) processing" screen; and the processing of the transaction depends on where the payment originates from, and what the destination Managed AccountManaged Account An account held at a financial institution that can be created and managed through the Weavr platform. Each account has a balance where customers can hold funds. Optionally, an IBAN can be assigned to enable wire transfers to bank accounts outside of Weavr. can accept. Example scenarios are:

- IWTsIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds. with specific sender-information

- IWTsIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds. to Linked Accounts

- IWT Forwarding Event

Once processing is successful, the funds are credited to the managed accountManaged Account An account held at a financial institution that can be created and managed through the Weavr platform. Each account has a balance where customers can hold funds. Optionally, an IBAN can be assigned to enable wire transfers to bank accounts outside of Weavr. and Weavr sendsSend A transaction type that allows sending funds to another identity's instrument or to a beneficiary. Send transactions may require Strong Customer Authentication depending on the destination and whether it's a trusted beneficiary. a deposit webhook notification to your application.

Simulate IWTIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds. by account ID via the Portal

If you need to quickly credit a Managed AccountManaged Account An account held at a financial institution that can be created and managed through the Weavr platform. Each account has a balance where customers can hold funds. Optionally, an IBAN can be assigned to enable wire transfers to bank accounts outside of Weavr.—such as for testing purposes—you can bypass the standard processing flow by using the "IWTIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds. by Account ID" feature in our Sandbox portal. This method allows you to directly apply funds to the account without simulating a realistic payment journey, making it ideal for setting up test scenarios efficiently.

To apply funds via IWTIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds. by account ID:

- Log in to the MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. Sandbox Portal using your credentials.

- Navigate to Simulator > Incoming Wire TransfersWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP). (IWTIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds.) by account ID.

- Fill out the form with the required details and click Simulate.

Using the Simulator API

# Replace $WEAVR_API_KEY with your API key found on the API Credentials page in the Multi Portal.

# For USD IWTs, replace $USD_IBAN with the value of the `bankAccountDetails.details.iban` field in the response object returned by managedAccountIBANGet.

# For USD IWTs, replace $PAYMENT_REFERENCE with the value of the `bankAccountDetails.paymentReference` field in the response object returned by managedAccountIBANGet.

# Replace $CURRENCY with the ISO-4217 code of the deposit currency that you would like to simulate.

# Replace $IWT_AMOUNT with the incoming wire transfer amount that you would like to simulate. The amount should be scaled to the lowest denomination of the currency.

# For EUR IWTs, replace $EUR_IBAN with the value of the `bankAccountDetails.details.iban` field in the response object returned by managedAccountIBANGet.

# For GBP IWTs, replace $SORT_CODE with the value of the `bankAccountDetails.details.sortCode` field in the response object returned by managedAccountIBANGet.

# For GBP IWTs, replace $ACCOUNT_NUMBER with the value of the `bankAccountDetails.details.accountNumber` field in the response object returned by managedAccountIBANGet.

curl --location --request POST 'https://sandbox.weavr.io/simulate/api/accounts/deposit' \

--header 'Content-Type: application/json' \

--header 'programme-key: {{$WEAVR_API_KEY}}' \

--data-raw '{

"iban": "{{$USD_IBAN}}",

"paymentReference": "{{$PAYMENT_REFERENCE}}",

"depositAmount": {

"currency": "{{$CURRENCY}}",

"amount": "{{$IWT_AMOUNT}}"

},

"destinationIban.Details": {

"iban"; "{{$EUR_BAN}}"

},

"destination.FasterPaymentsDetails": {

"sortCode": "{{$SORT_CODE}},

"accountNumber": "{{$ACCOUNT_NUMBER}}"

}

}'

Simulate IWTIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds. processing via the Portal

You can use the Sandbox Portal to simulate Incoming Wire TransfersWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP). for the following scenarios:

-

IWTsIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds. to Linked AccountsLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers. This type of testing is only available if your operational model supports Linked AccountsLinked Account An entity in the Weavr system that represents an external bank account or payment service provider (PSP) account which an Identity has verified they own and control. This feature enables users to perform transactions, such as outgoing and incoming wire transfers, between their Linked Accounts and their Managed Accounts as 'self-to-self' transfers.. Confirm your model configuration before proceeding.

-

IWTIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds. Forwarding Event You can also simulate scenarios involving forwarding of incoming wire transfersWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP)..

To simulate an IWTIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds.:

- Log in to the Multi Sandbox Portal using your credentials.

- Navigate to Simulator > Incoming Wire TransfersWire Transfer A transaction that moves funds between accounts. An incoming wire transfer moves funds from a third-party bank account to a Weavr managed account, while an outgoing wire transfer moves funds from a Weavr managed account to a third-party bank account. Wire transfers require the managed account to have an assigned IBAN (for EUR) or sort code and account number (for GBP). (IWTIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds.) processing.

- Input the details in the form and click on Simulate.

You can find the IBANIBAN International Bank Account Number - a standardized international bank account identifier. Managed accounts can be assigned an IBAN to enable wire transfers to and from bank accounts outside of Weavr. IBANs are required for EUR accounts and enable SEPA transfers. or sort code and account number and the payment reference (for USD IWTsIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds.) of a managed accountManaged Account An account held at a financial institution that can be created and managed through the Weavr platform. Each account has a balance where customers can hold funds. Optionally, an IBAN can be assigned to enable wire transfers to bank accounts outside of Weavr. in the MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. Portal by navigating to Home > Identity > Managed AccountsManaged Account An account held at a financial institution that can be created and managed through the Weavr platform. Each account has a balance where customers can hold funds. Optionally, an IBAN can be assigned to enable wire transfers to bank accounts outside of Weavr. > Details.

Not all managed accountsManaged Account An account held at a financial institution that can be created and managed through the Weavr platform. Each account has a balance where customers can hold funds. Optionally, an IBAN can be assigned to enable wire transfers to bank accounts outside of Weavr. have a payment reference assigned to them. You only need to specify the payment reference for IWTsIWT Incoming Wire Transfer - a transaction that occurs when funds from a bank account held at a third-party financial institution are moved to a Weavr managed account. IWTs are initiated externally by the owner of the source bank account, and the managed account must have an assigned IBAN to receive funds. to USD Managed AccountsManaged Account An account held at a financial institution that can be created and managed through the Weavr platform. Each account has a balance where customers can hold funds. Optionally, an IBAN can be assigned to enable wire transfers to bank accounts outside of Weavr..

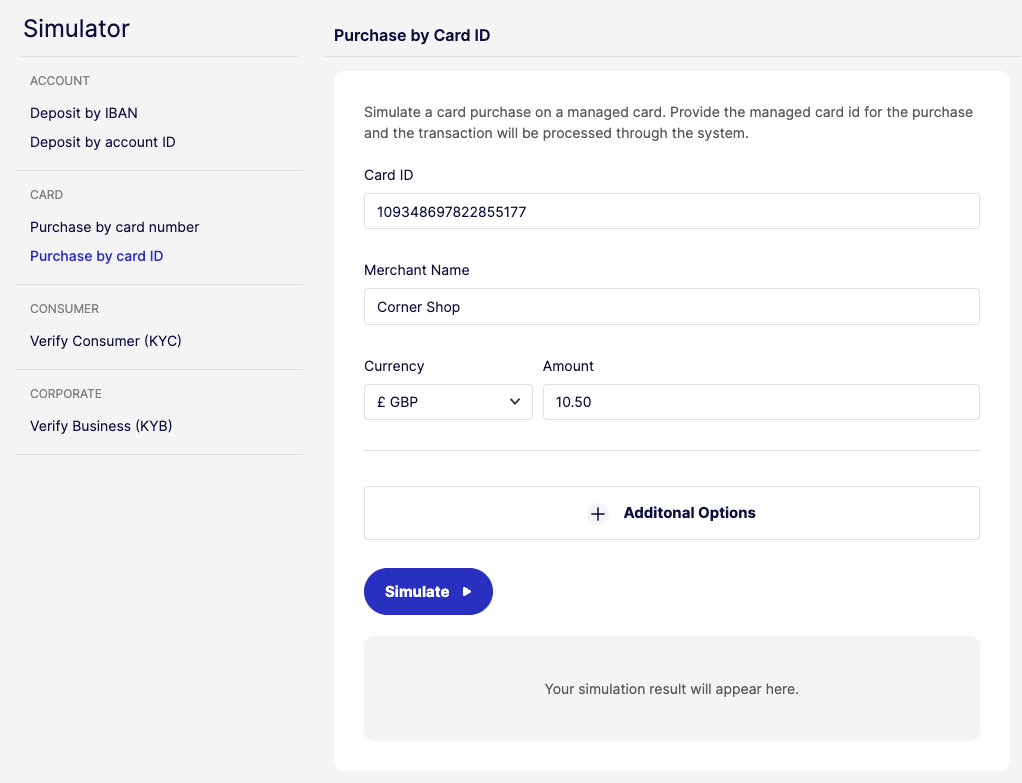

Card Purchase

After Weavr issues a card, you can expect its cardholder to use it to make a purchase.

When Weavr is notified of a new purchase on a card, Weavr automatically updates the card’s balance and statement and sendsSend A transaction type that allows sending funds to another identity's instrument or to a beneficiary. Send transactions may require Strong Customer Authentication depending on the destination and whether it's a trusted beneficiary. a card purchase webhook notification to your application.

Using the Simulator API

# Replace $WEAVR_API_KEY with your API key found on the API Credentials page in the Multi Portal.

# Replace $CARD_ID with the value of the `id` field in the response object returned by managedCardGet.

# Replace $MERCHANT with the name that should be displayed as the merchant name for the simulated purchase.

# Replace $CURRENCY with the ISO-4217 code of the purchase currency that you would like to simulate.

# Replace $PURCHASE_AMOUNT with the purchase amount that you would like to simulate. The amount should be scaled to the lowest denomination of the currency.

curl --location --request POST 'https://sandbox.weavr.io/simulate/api/cards/{{$CARD_ID}}/purchase' \

--header 'Content-Type: application/json' \

--header 'programme-key: {{$WEAVR_API_KEY}}' \

--data-raw '{

"merchantName": "{{$MERCHANT}}",

"transactionAmount": {

"currency": "{{$CURRENCY}}",

"amount": {{$PURCHASE_AMOUNT}}

}

}'

Using the Simulator UI

- Log in to the Multi Sandbox Portal using your credentials.

- Navigate to Simulator > Purchase by card ID.

- Input the details in the form and click on Simulate.

By selecting Additional Information you will be able to include the following parameters to your simulation:

| Field | Description |

|---|---|

| Merchant ID | Merchant’s unique identification number provided by the payment processor. |

| Merchant Category Code | 4 digit number used to classify merchant’s business by services provided. |

| Forex Fee | Fee taken from the card for a purchase that involves foreign exchange (e.g. a cardholder uses an EUR card to make a purchase at a merchant who accepts USD) |

| Forex Padding | Additional padding to the forex amount |

You can find the card ID of a card in the MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. Portal by navigating to Home > Identity > Card > Details.

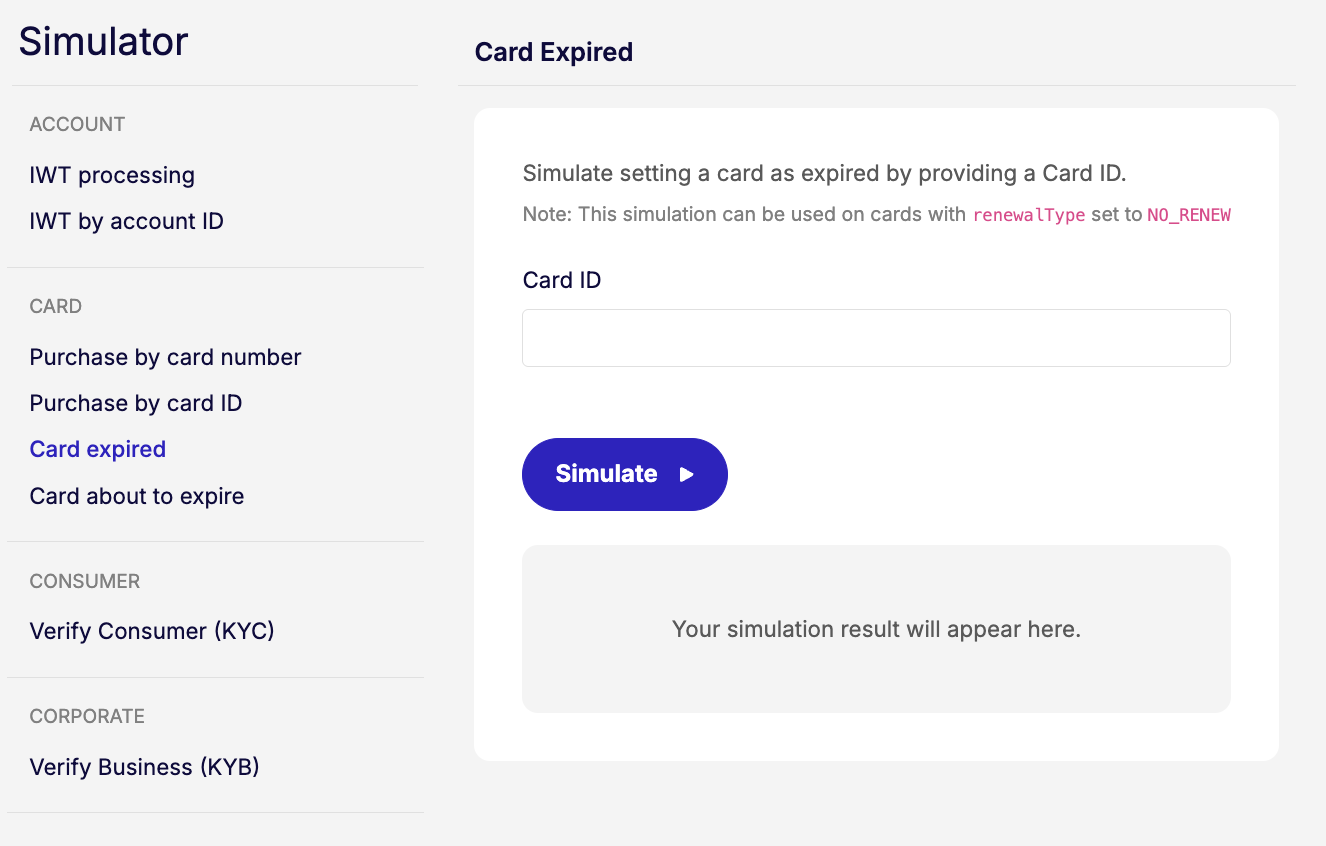

Card Expiry

Weavr sendsSend A transaction type that allows sending funds to another identity's instrument or to a beneficiary. Send transactions may require Strong Customer Authentication depending on the destination and whether it's a trusted beneficiary. Card Notifications to inform you of events related to card expiry. More information is available here.

You can simulate a card expiry scenario as follows:

Using the Simulator API

# Replace $WEAVR_API_KEY with your API key found on the API Credentials page in the Multi Portal.

# Replace $CARD_ID with the value of the `id` field in the response object returned by managedCardGet.

curl --location --request POST 'https://sandbox.weavr.io/simulate/api/cards/{card_id}/expire' \

--header 'Content-Type: application/json' \

--header 'programme-key: {{$WEAVR_API_KEY}}' \

--data-raw '{

"card_id:": "{{$card_id}}"

}

}'

Using the Simulator UI

- Log in to the Multi Sandbox Portal using your credentials.

- Navigate to Simulator > Card expired.

- Input the details in the form and click on Simulate.

You can find the card ID for a particular card in the MultiMulti Weavr Multi is an embedded finance solution that allows you to integrate financial services into your own application, providing a seamless experience for your customers. It enables you to offer managed accounts, managed cards, and transactions without requiring financial expertise. Portal by navigating to Home > Identity > Card > Details.

Card about to expire

Weavr sendsSend A transaction type that allows sending funds to another identity's instrument or to a beneficiary. Send transactions may require Strong Customer Authentication depending on the destination and whether it's a trusted beneficiary. card notifications to keep you informed about upcoming card renewals, helping you take the necessary actions in time. More information on the card renewal process is available here

You can simulate a scenario of a card about to expire as follows:

Using the Simulator API

# Replace $WEAVR_API_KEY with your API key found on the API Credentials page in the Multi Portal.

# Replace $CARD_ID with the value of the `id` field in the response object returned by managedCardGet.

curl --location --request POST 'https://sandbox.weavr.io/simulate/api/cards/{card_id}/about_to_expire' \

--header 'Content-Type: application/json' \

--header 'programme-key: {{$WEAVR_API_KEY}}' \

--data-raw '{

"card_id:": "{{$card_id}}"

}

}'

Using the Simulator UI

- Log in to the Multi Sandbox Portal using your credentials.

- Navigate to Simulator > Card about to expire.

- Input the details in the form and click on Simulate.