Reject duplicate identities for consumers programmes

We are launching a new feature that will block same user creating multiple identities on your programme. This is going to help you:

- Prevent fraud

- Increase security

- Improve customer support

- Enhance compliance

- Reduce costs

When detecting a duplicate identity, we will communicate via webhook the following:

-

identity_id

-

reason of rejection

-

state of the account

-

timestamp

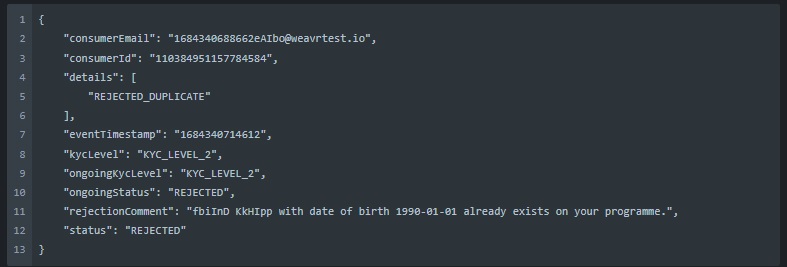

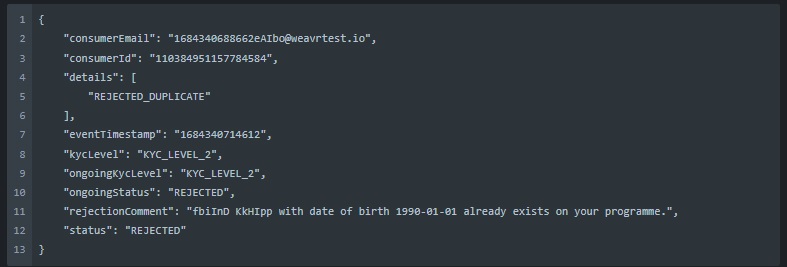

Here’s an example of a response for a Duplicate identity:

Reversal of returned Outgoing Wire Transfers

We are improving the processing of transactions if an Outgoing Wire Transfer is returned by the beneficiary bank or other payment service provider, and making the status of the original Outgoing Wire Transfer clearer.

If an Outgoing Wire Transfer was sent successfully, but ultimately refused and returned by the beneficiary bank, the funds will be credited back to the managed account, as well as any fees (this option can be selected via a new portal option). The original Outgoing Wire Transfer will also be updated with a new state RETURNED (currently the Outgoing Wire Transfers remain in the state COMPLETED). When calling a statement there will be a new transactionState entry with a RETURNED state, indicating the OWTs that were returned.

A new state RETURNED will be added to the “Outgoing Wire Transfer transaction” webhook, and will be sent if an Outgoing Wire Transfer is updated to this state.

The Outgoing Wire Transfers will also have the state RETURNED in the following APIs

GET: outgoing_wire_transfers

GET: outgoing_wire_transfers/\id\}

GET: managed_accounts/{id\}/statement

In the portal, in the Managed Account activity statement, the original Outgoing Wire Transfer will have a tag displayed “RETURNED”.

Previously, an OWT would never transition beyond a COMPLETED state. However, it will now be possible for an OWT to transition from COMPLETED to RETURNED.

Restrictions on onboarding Non Profit Organisations

This change will impact you if you plan to onboard charities or non-profit organisations, because financial services for these types of organisation are no longer supported.

The full list of supported company types is listed in the API documentation, and the restriction of non-profit organisations will be enforced when creating a corporate using POST multi/corporates.

Corporates of type NON_PROFIT_ORGANISATION will not be accepted and if you attempt to onboard a company having company.type = NON_PROFIT_ORGANISATION, a 409 COMPANY_TYPE_UNSUPPORTED conflict response will be returned.

Country of residence required upon consumer identity creation

The end consumer’s country of residence is key information that is required at the very first step of onboarding (consumer creation) so that the consumer can be directed to the correct onboarding flow depending on the jurisdiction in which they reside.

Currently, when creating a consumer identity using POST /multi/consumers, the country of residence of the consumer (rootUser.address.country) is optional. In such cases, the country would be provided later, during the due diligence process.

We are now making the country of residence mandatory immediately upon creation, in POST /multi/consumers. This will be used to help determine the appropriate due diligence process that the user needs to go through.

If a country is not provided in the call, the API will respond with 400 Bad Request Error.

Removing “Set spend rules for a managed card” deprecated API

The deprecated “Set spend rules” PUT API will be removed in favour of the 3 existing API endpoints:

Create spend rules config API endpoint: This new POST API endpoint should be used when setting up the spend rules for the first time on a card.

Update spend rules config API endpoint: This new PATCH API endpoint should be used when spend rules have already been set on a card and these need amending to add or alter the rules that are currently configured.

Delete spend rules config API endpoint: This new DELETE API endpoint should be used when spend rules need to be removed that are currently configured on a card.

Unlike the PUT spend rules API endpoint, when using the create, update and delete spend rules API endpoints, only the rules that you want to configure need to provided. The rules that do not apply can be left out.

Affected APIs:

PUT /managed_cards/\{id\}/spend_rules

POST /managed_cards/\{id\}/spend_rules

PATCH /managed_cards/\{id\}/spend_rules

DELETE /managed_cards/\{id\}/spend_rules

Retrieving Spend Rules

The current spend rules response combines all rules that apply. This response object will be deprecated and the Get Spend Rules API endpoint enhanced to contain three response objects (groupings):

Card level spend rules: These are spend rules that are associated with the specific card itself

Identity level spend rules: These are spend rules that are associated with the cardholder (owner of the card).

Profile level spend rules: These are the spend rules that are configured in the Multi portal > Settings > Managed Cards screen

Please note that the response objects will only contain rules that have been configured within its group, thereby omitting all un-configured rules.

Affected APIs:

GET /managed_cards/\{id\}/spend_rules