Version 3.62.0

Enhancements within data insights physical cards dashboard

We have rolled out enhancements to the Physical Cards Data Insights dashboard, aimed at improving visibility into card stock levels and delivery operations. Within the Analysis tab, you can now find:

A new Stock Availability chart, providing a clear view of current inventory levels, including the consumed percentage of available cards to give you an immediate insight into stock usage trends; A new Physical Card Orders chart, displaying all physical card orders placed over the last 12 months, along with the associated delivery addresses and tracking numbers, offering a detailed look at distribution patterns and fulfilment activity These updates are part of our ongoing commitment to delivering sharper, actionable insights and streamlining operational management within the platform.

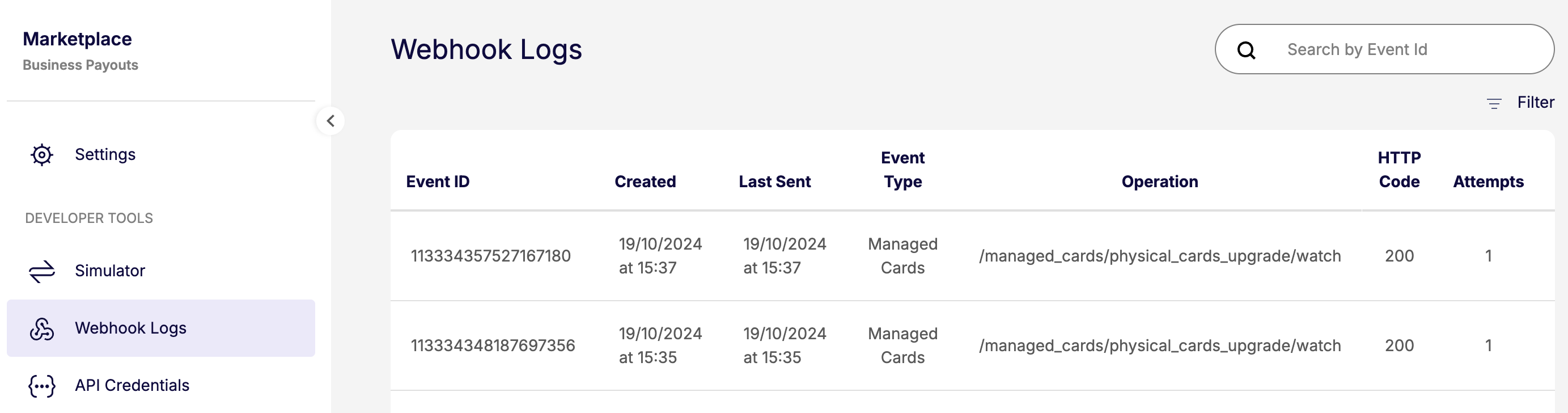

Bulk Processes in embedder portal

It is now possible to view current and historic Bulk Processes in the embedder portal.

Currently you can track the progress of the operations in a Bulk Process via the multi API, and via webhooks. We have now added full visibility in the embedder portal.

Here you can view all Bulk Processes, their status', and the underlying operation that was performed. You can see a summary of the underlying operations, for example whether all operations were executed successfully, via the side-panel.

You can click on a Bulk Process to see the full API details of each underlying operation; helpful for investigating or troubleshooting any issues.

Marking virtual cards as compromised

We have introduced a new feature that allows you to mark a virtual card as compromised directly from the embedder portal. With just a click, you’ll have the option to:

Mark the card as compromised and issue a replacement–Automatically destroys the affected card and generates a new one.

Mark the card as compromised and transfer funds–Move the remaining balance to another instrument linked to the same identity.

Mark the card as compromised without replacement–Destroys the affected card without issuing a new one or transferring funds.

This enhancement provides more control and flexibility when managing compromised virtual cards.

Handle more MCCs and MIDs in spend rules

When creating or updating spend rules in our Embedder Portal and Multi, you can now add up to 200 allowed or disallowed MIDs and MCCs.

API details

-

POST /multi/managed_cards/{id}/spend_rules -

GET /multi/managed_cards/{id}/spend_rules -

PATCH /multi/managed_cards/{id}/spend_rules

Biometrics and UI components, mobile SDK releases

The Weavr mobile SDK for iOS, Android, and React Native platforms allows you to embed financial services into your own app, providing a seamless experience for your customers.

Recent improvements introduced in the Biometrics and UI components include:

- The Biometric Authentication component now supports the initial authentication, and fallback authentication, of the end user via password, rather than only passcode.

- The React Native SDK has been updated to support React Native's new architecture, and leverages the Expo-modules API to simplify maintenance.