Version 3.44

Enhanced API Key management

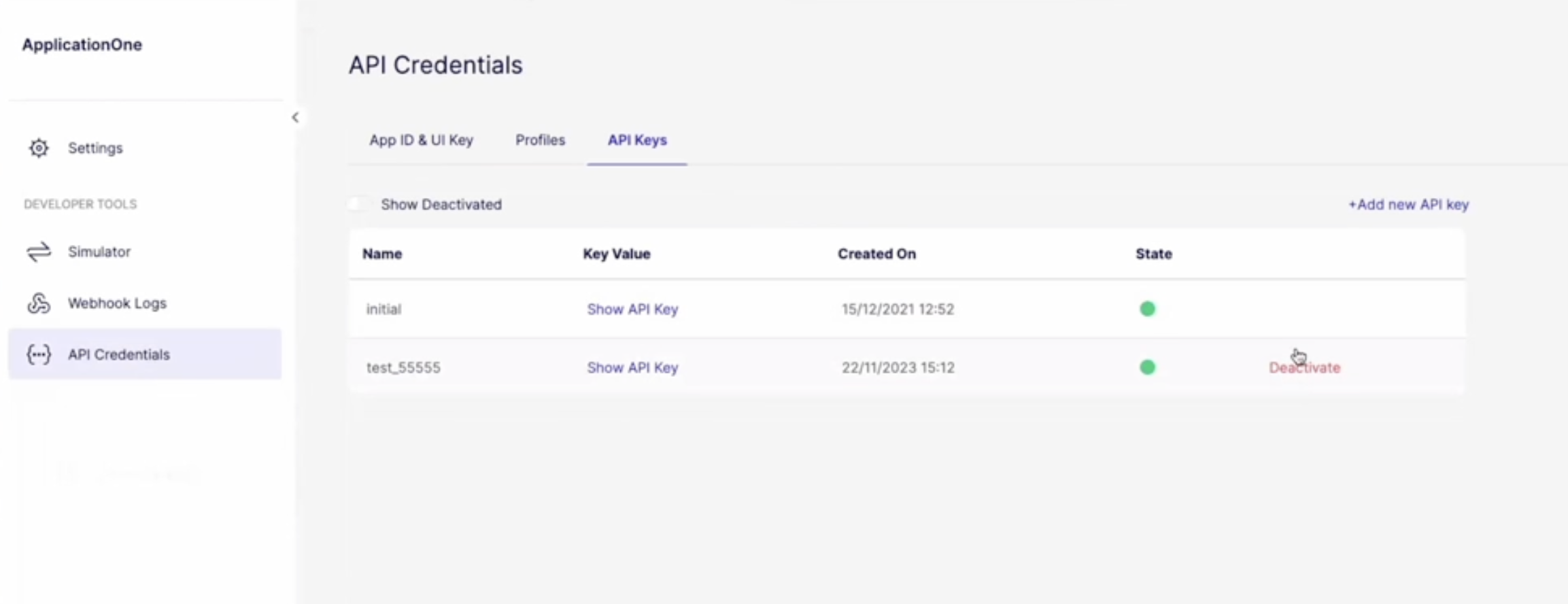

Embedders now have the flexibility of managing and rotating API keys, ensuring secure usage and storage. These options are conveniently accessible on the API Credentials page, within the Embedder portal.

This enhancement introduces three new options for managing API Keys:

- Creating additional API Keys: Create multiple API keys to support various use cases and enhance security measures. To create a new key, Embedders should navigate to the API Keys tab and click "Add New API Key".

- Rotating between keys: Easily switch between different API keys, ensuring secure usage. Embedders can click to reveal and copy the key provided within the API Keys tab.

- Deactivating an API key: In the event of security concerns or changes in access requirements, Embedders can deactivate API keys as needed. Once deactivated, an API key cannot be reactivated.

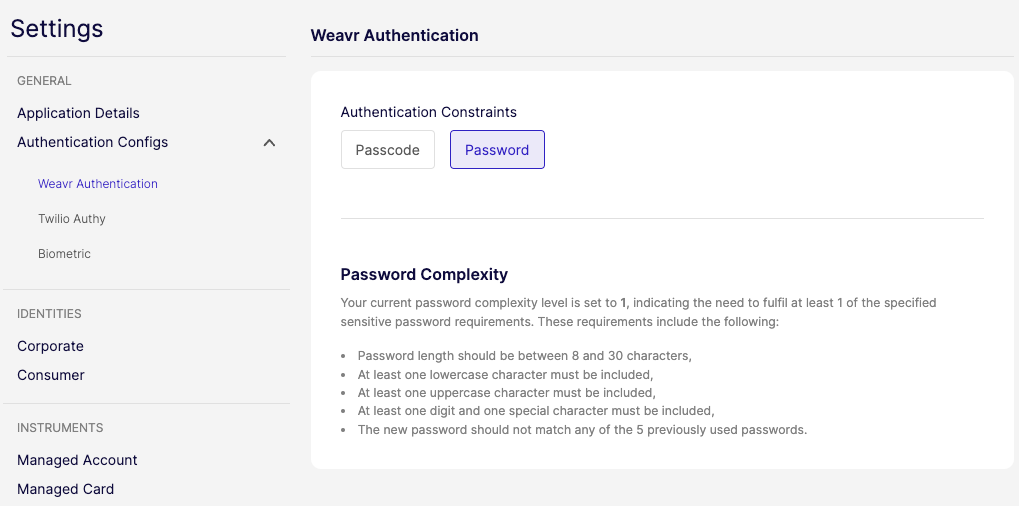

Alternative Step-up via fallback SMS channel

Embedders may use different channels for stepping-up a token: SMS, Twilio Authy or Biometrics. In situations where users encounter difficulties accessing Twilio Authy for authentication, Embedders can now initiate the SMS channel as a fallback. This ensures that users still receive the verification code and can successfully confirm the challenge.

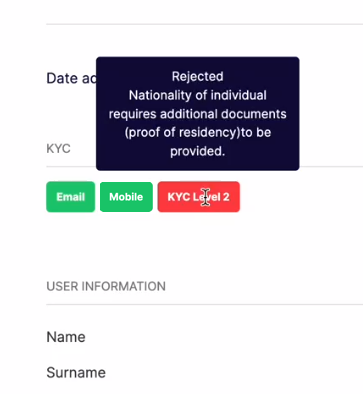

Enhanced User Verification Indicators

To prevent confusion in interpreting user verification statuses, the verification indicators now feature new, distinct, and recognisable colours corresponding to their respective statuses:

- Upon creating a new user, the email and mobile verification indicators will now appear grey instead of red.

- When a new user starts verifying the email or mobile, the verification indicators will be displayed yellow, not red.

- Upon successful verification of the email or mobile, the verification status will continue to be indicated in green.

Enhanced Data Insights Dashboard

To ensure Embedders can closely monitor the progress and operations of their customers, the Data Insights Dashboard has been enriched with the following information:

- The details table within the KYC Overview dashboard includes a new Rejection Comment column, showing the reason why a consumer failed a KYC submission.

- The Card Settlements and Fees Details dashboards now include new filtering options:

- a. Managed Card ID, Merchant Name and Merchant Category Code filters, within the Card Settlements dashboard

- b. Instrument Friendly Name, Card Last 4 Digits, Merchant Category and Merchant Category Code (where applicable), within the Fees Details dashboard.